Understanding basic financial analysis

Assessing the effectiveness and suitability of businesses, projects, budgets, and other financial-related transactions is done through financial analysis. Financial analysis is typically used as a technique for determining if a company is trustworthy, solvent, liquid, or profitable enough to merit a financial investment.

Economic trends are evaluated through financial analysis, and financial rules are established, long-term company activity plans are developed, and potential investment opportunities are identified. This is accomplished by fusing financial data with numerical data. An income statement, balance sheet, and cash flow statement of a firm will all be carefully examined by a financial analyst. Financial analysis can be done in both corporate and investment finance situations.

In corporate finance, internal analysis is carried out by the accounting division and communicated to management to help with business decision-making. To determine which initiatives are worthwhile performing, this type of internal analysis may incorporate ratios like net present value (NPV) and internal rate of return (IRR).

Fundamental analysis and technical analysis are the two categories of financial analysis.

Fundamental Analysis

To ascertain a company’s value, fundamental analysis analyses ratios derived from the information found in the financial statements, such as its profits per share (EPS).

Technical Analysis

Moving averages and other statistical trends gleaned from trade activity are used in technical analysis (MA). Technical analysis focuses on the statistical examination of price movements since it essentially believes that the price of security already represents all information that is generally available.

Role of financial analysis in coursework and Assignments

Without a doubt, having a good financial education helps one make sense of their life and gives the direction and purpose of their financial decisions. By developing the practice of financial planning, one can effectively manage their finances by having control over their income, expenses, and assets.

It is crucial to remember that financial literacy is not just something that should be acquired by individuals; it is also something that governments and organizations should do because it has many benefits and, most importantly, prevents them from going into debt.

Ways to conduct theoretical research in your financial analysis assignment

Let us shortly understand what theoretical research is. Theoretical inquiry is a logical investigation into a set of presumptions and beliefs. This kind of research entails theorizing or describing how a cyber system behaves in relation to its environment, followed by examining or simulating the ramifications of that definition.

We, at Chanakya Research, help MBA students with their assignments on financial analysis. Our ratio analysis tool for academic studies paints a picture of the type of thinking and analysis performed by hedge funds. To help us make wiser financial judgments, our qualified financial analysts examine a company’s financial statements. The income statement, balance sheet, statement of cash flows, and statement of changes in equity are among these statements. These are the main ways you can also conduct theoretical research in your financial analysis assignment by yourself.

Apart from that, to satisfy our clients’ needs for corporate, industrial, thematic, economic, and library research, we offer specialized research across sectors for financial analysis. We also explore case studies and research themes in behavioral finance, corporate finance, and corporate governance, as well as asset pricing (equity, fixed income, and derivatives).

Ways to conduct empirical research in your financial analysis assignment

Let us also know what empirical research is. Empirical research is a study that relies on empirical data. It is a technique for learning as well, using both direct and indirect experience or observation. Some types of study are valued by empiricism more than others. Either a quantitative or qualitative analysis can be done on empirical data.

The emerging field of empirical financial research and the established field of empirical economic research are linked by our analysts at Chanakya Research. As a result, we cover a wide range of theoretical and practical aspects of empirical economic and financial research, such as time series and business cycle analysis.

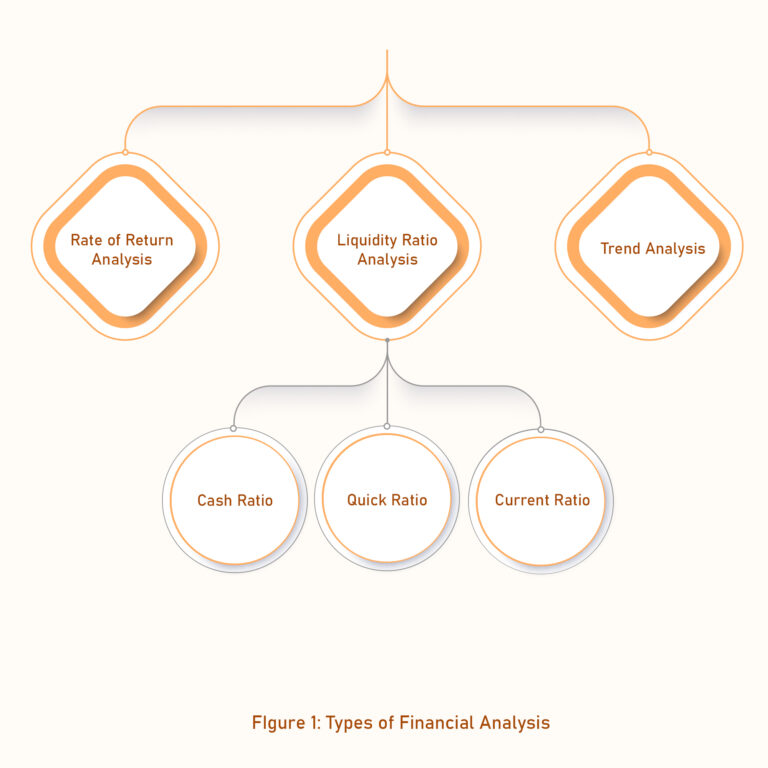

We do financial analysis using a number of trustworthy techniques, including ratio analysis, funds flow analysis, trend analysis, common size statements, and comparative financial statements. All of the aforementioned techniques can be used to undertake financial research by our analysts. These are the main ways you can also conduct empirical research in your financial analysis assignment by yourself.

Conclusion

Finally, we can conclude that financial analysis not only can help in coursework and assignment of an individual but also is essential for educating people on managing their finances effectively. We, at Chanakya Research, can help you with your coursework and assignment in financial analysis at an affordable cost So, what are you waiting for? Just visit our website https://www.chanakya-research.com/ to learn more about it.